How to Check the Status of Your Tax Return Online (2021)

How to Check the Status of Your Tax Return Online (2021): The development kid tax reduction installments beginning July 15 and week after week groups of improvement look as yet going. The IRS has all that anyone could need on its plate to manage as it measures expense forms and conveys charge discounts this late spring. In the event that you are as yet sitting tight for your discount. Here is the thing that could be holding up your cash and how to keep an eye on its status.

The IRS attempts to hit a “21 days or less” timetable for sending discounts, however for those holding up past the cutoff time, attempting to arrive at the IRS through its telephone number may not be a lot of help. Luckily, the IRS has online devices that can give you customized discount data on the situation with your expense form.

We’ll assist you with understanding why your discount could be held up and how to follow it with web apparatuses. On the off chance that you have kids. There are approaches to know whether you meet all requirements for the development of a month-to-month youngster. Tax break installments that beginning one month from now. As a side note.

What could be holding up your tax refund?

In light of the pandemic, the IRS ran a confined limit in 2020, which put a strain on its capacity to deal with assessment forms and convey improvement checks. The IRS is open again and handling mail, assessment forms, installments, discounts, and correspondence, yet restricted assets keep on creating setbacks.

When IRS said it’s responsible for most discounts in under 21 days this moment, yet some are taking longer, including for sent paper expense forms and manual preparing. The IRS said it’s likewise requiring some investment for 2020 expense forms that require a survey, for example, deciding recuperation refund credit sums for the first and second improvement checks – or figuring acquired personal tax break and extra kid tax reduction sums.

Here’s a rundown of reasons your discount may be deferred:

- Your expense form has blundered.

- It’s inadequate.

- Your discount is associated with fraud or extortion.

- You petitioned for the acquired annual tax reduction or extra youngster tax break.

- Your return needs a further audit.

- Your return incorporates Form 8379 (PDF), harmed mate designation – this could require as long as 14 weeks to measure.

What do these three status messages mean from the IRS?

The two IRS devices (on the web and portable application) will show you one of three messages to clarify your expense form status.

- Gotten: The IRS presently has your assessment form and is attempting to deal with it.

- Endorsed: The IRS has prepared your return and affirmed the measure of your discount, in case you’re owed one.

- Sent: Your discount is currently en route to your bank through the ct store or as a paper check to your letter drop. (Here are the means by which to change the location on a document on the off chance that you moved.)

How exactly do you track your IRS tax refund online?

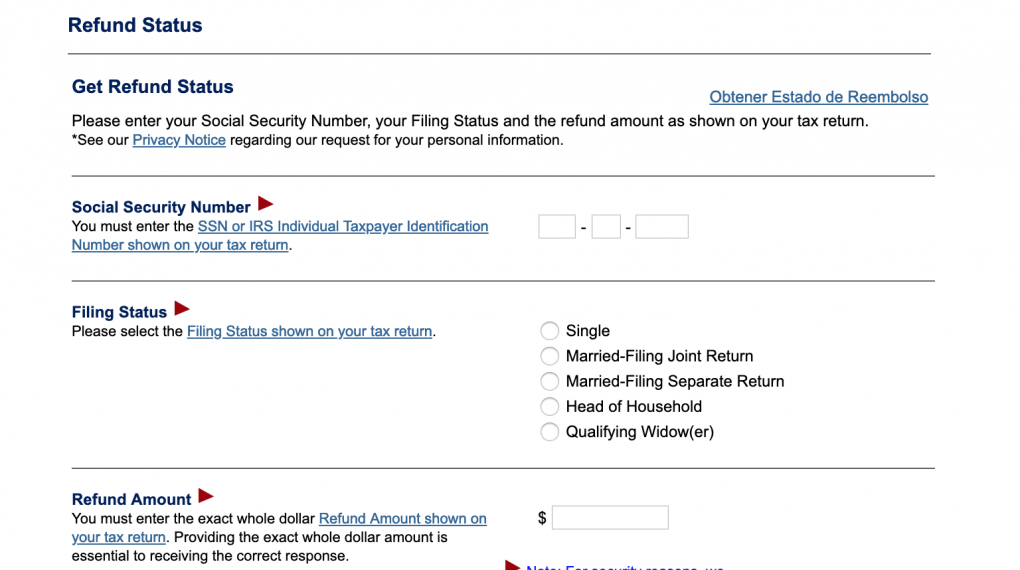

To check the situation with your personal expense discount utilizing the IRS tracker devices, you’ll need to give some data: your Social Security number or Individual Taxpayer Identification Number, your recording status – single, hitched, r head of the ly – and your discount sum in entire dollars, How to Check the Status of Your Tax Return Online (2021), which you can discover on your assessment form. Additionally, ensure it’s been at any rate 24 hours before you have a go at following your discount.

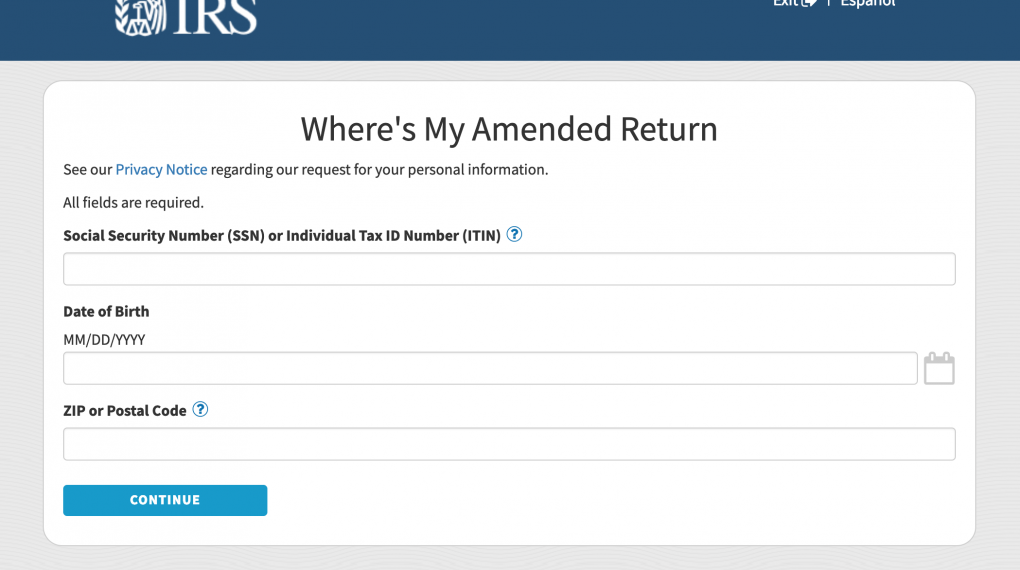

Utilizing the IRS apparatus Where’s My Refund, enter your SSN or ITIN, your documenting status, and your precise discount sum, then, at that point press Submit. On the off chance that you entered your data accurately. You have taken to a page that shows your discount status. If not, you might be approached to confirm your own duty information and attempt once more.

The IRS additionally has a versatile application considered IRS2Go that checks your duty discount status. The IRS refreshes the information in this device short-term, so in the event that you don’t see a status change following 24 hours or more, return the next day.

Also, Read: Best Safe ROM Download Sites

What is the IRS TREAS 310 direct deposit in your bank account?

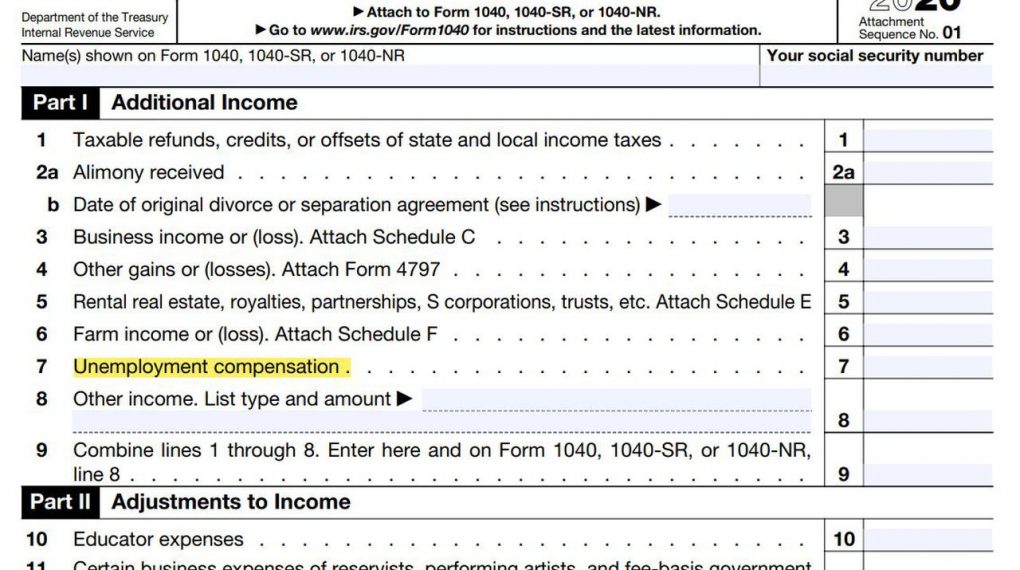

On the off chance that you accept your assessment discount by direct store, you may see IRS TREAS 310 for the exchange. The 310 distinguishes the exchange rate as an IRS charge discount. This would likewise apply to those getting a programmed change on their government form or a discount because of the enactment of tax-exempt joblessness benefits. You may likewise see TAX REF in the depiction field for a discount.

How much time will you have to wait for your refund to arrive?

The IRS normally gives charge discounts within three weeks. Yet a few citizens have been holding up longer than a month to accept their installments. On the off chance that there are any blunders, it may take the organization longer to measure and issue your assessment discount. The equivalent goes for individuals who recorded a case for a procured personal tax reduction or the kid tax break.

The date you get your duty discount likewise relies upon how you documented your return. For instance, with discounts going into your ledger by means of a direct store. It anything but an extra five days for your bank to present the cash for you. This implies on the off chance. That it took the IRS the full 21 days to give your check and your bank five days to post it, you might be holding up a sum of 26 days to get your cash.

How can you check the status of your unemployment tax refund?

The individuals who gathered joblessness benefits in 2020 and recorded. Their expense forms early have begun to get extra duty discounts from the IRS. Under new principles from the American Rescue Plan Act of 2021. A great many individuals who paid duty on joblessness remuneration could be qualified for a strong amount of cashback.

In any case, it probably won’t be feasible to follow the situation with that discount utilizing the online instruments above. To discover when the IRS handled your discount and for the amount. We suggest finding your assessment record by signing in to your record and review the exchanges recorded there.